Double materiality assessment

Prioritise what truly matters in your ESG strategy and reporting.

Double materiality is where clarity begins.

It defines what matters most – for your ESG strategy, reporting, and long-term resilience.

Understand your business’s most significant impacts on people and nature. Identify the sustainability risks and opportunities that shape financial success.

Whether you’re preparing for reporting, refining strategy, or future-proofing your decisions, this is your foundation.

Built to align with the CSRD and beyond.

Services

Double Materiality Assessment

We assess how your business affects the world. And how the world affects your business.

Our approach combines impact and risk perspectives to identify the ESG topics that truly matter.

The result is a focused view of your priorities. Ready to guide strategy, reporting, and decision-making in line with CSRD and leading standards.

DMA Lite

A simplified version of double materiality, designed for companies not (yet) in CSRD scope.

DMA Lite helps you identify your key ESG topics without full ESRS scoring or reporting burden. Built on the same principles as a full assessment, it gets you clarity — quickly and affordably.

Ideal for SMEs, voluntary reporters, and strategy pre-work.

Real Impact.Measurable Results.

See exactly where your emissions come from — and what to do about them. Our Climate Impact Assessment delivers actionable insights, regulatory alignment, and clear reduction pathways tailored to your business.

alignment with GHG Protocol and CSRD requirements

of users report improved clarity in climate-related decisions

visibility into Scope 1, 2, and 3 emissions (up to)

Who benefits?

Designed for companies ready to prioritise what truly matters – to their business and to the world around them.

Small and Medium Enterprises (SMEs)

Competitive Advantage

SMEs can benefit by demonstrating a strong ESG management approach to B2B clients, value chain partners, banks, and investors.

Market Opportunities

Enhance market positioning and meet the sustainability expectations of larger partners.

Large Companies

Regulatory Requirement

All large companies meeting at least two of the following at the consolidation group level:

- 250+ employees

- €50+ million net turnover

- €25+ million total assets

CSRD Compliance

Mandatory under the CSRD for large companies and all companies listed on regulated markets in the EU (except micro-enterprises).

Proactive Organizations

Efficient Resource Allocation

Companies aiming to allocate resources thoughtfully and avoid investing in sustainability issues that offer limited relevance or impact, ensuring their efforts focus on truly material topics.

Strategic Planning

Businesses seeking to integrate ESG considerations into their strategic planning effectively.

Why it matters?

Because every tonne counts.

Strategic Resource Allocation

Focus on What Matters

Allocate resources thoughtfully and efficiently to the most significant ESG issues.

Enhance Decision-Making

Make informed decisions based on a comprehensive understanding of material impacts, risks and opportunities.

Stakeholder Trust

Improve Transparency

Demonstrate commitment to sustainability to investors, clients, and partners.

Strengthen Relationships

Build trust with stakeholders by addressing the ESG topics that matter most to them.

Competitive Advantage

Stay Ahead

Proactively manage sustainability issues to gain an edge over competitors.

Attract Investment

Appeal to investors seeking companies with robust ESG management.

Regulatory Compliance

Meet Mandatory Requirement

Comply with EU regulations such as the CSRD by conducting a double materiality assessment.

Avoid Penalties

Reduce the risk of possible non-compliance fines and legal repercussions.

Double materiality assessment

Sustinere offers comprehensive support in conducting double materiality assessments, ensuring that your ESG initiatives focus on what truly matters.

Services are tailored to meet the specific needs of your organisation.

Additional services

Deepen your understanding, sharpen your impact

Regulatory and Industry Benchmarking

Assess your organisation’s ESG profile against industry standards, regulatory frameworks, and best practices, ensuring preparedness for emerging directives such as the CSRD.

Stakeholder Engagement

Engage with customers, suppliers, communities, and investors to ensure that the identified ESG topics are informed by stakeholder actions and expectations, resulting in materiality findings that genuinely reflect the interests of those your business affects and serves.

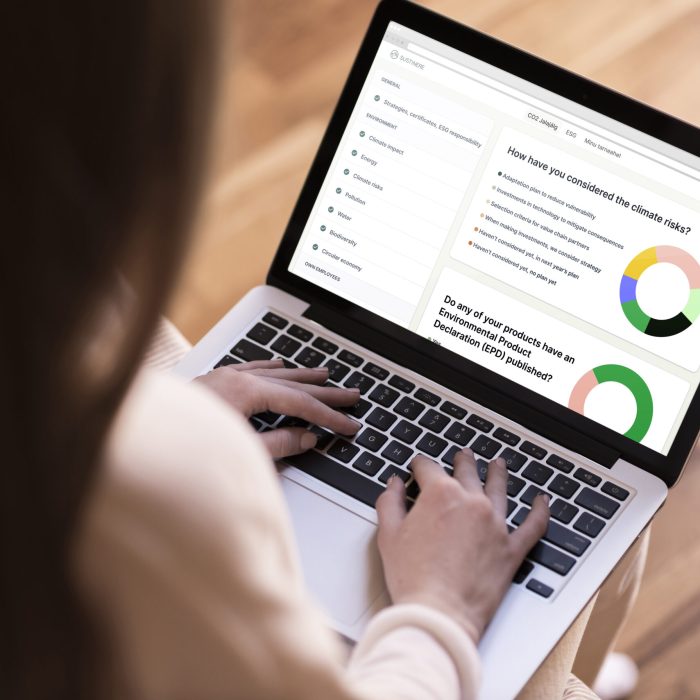

Data Systems Integration

Support in selecting and configuring ESG data management tools to continuously monitor and track material ESG issues, ensuring your materiality assessment remains current and actionable.

Reporting Assistance

Translate materiality findings into clear disclosures aligned with recognized reporting frameworks. Integrate the results into existing ESG reports and communications for transparency and credibility.

Strategic Alignment Session

Incorporate material ESG topics into the organization’s overall business strategy. Identify and address potential conflicts or synergies between strategic objectives and priority ESG issues.

Our process

Understanding the Context and Scope

Define Scope

Determine the breadth of the assessment considering your company’s value chain.

Information Gathering

Identify necessary input data and relevant stakeholders.

Engagement Planning

Plan how stakeholders should be engaged in the process.

Outcome

Clear understanding of why and how the assessment will be conducted.

Identification of Material ESG Impacts, Risks, and Opportunities

Topic Shortlisting

Create a shortlist of ESG topics that are truly relevant based on the identified potential impacts, risks, and opportunities.

Outcome

A focused list of ESG topics for further assessment.

Materiality Assessment from Two Perspectives

Impact Materiality

Assess the severity and likelihood of impacts on the environment and people caused by your business activities.

Financial Materiality

Evaluate sustainability-related risks and opportunities affecting the financial success of your business.

Materiality Map

Develop a materiality map with scores and explanations for each identified material impacts, risks and opportunitites.

Outcome

Comprehensive understanding of material ESG issues from both impact and financial perspectives.

The assessment is conducted using inputs from internal and external stakeholder engagement, reviews of available materials, interviews with management team members, and collaborative workshops.

Evaluations are based on industry standards and scientific materials.

After completing the double materiality assessment, a strategy can be developed to integrate material ESG aspects into your business strategy.

Additionally, disclosure points for reporting and gaps in complying with the EU’s ESG reporting standards can be identified.

We follow

European Sustainability Reporting Standards (ESRS) Requirements

Adherence to the principles and requirements outlined in the ESRS.

EFRAG Guidelines

Implementation of guidelines provided by the European Financial Reporting Advisory Group (EFRAG) for double materiality assessment.

Sustinere's Scoring Model and Templates

Utilisation of proprietary scoring models and worksheet templates for assessing the impact and financial materiality of each ESG topic.

Why choose Sustinere?

Save Time

Expert Handling

Allow your team to focus on core business activities while Sustinere manages the complexities of ESG assessments.

Comprehensive Coverage

Ensure nothing is overlooked in meeting ESRS requirements and EFRAG guidelines.

Budget-Friendly

Cost-Effective

Bringing in skilled experts can be more cost-effective than allocating significant internal resources.

Team Involvement

Your team remains involved, gaining insights and building capacity for future assessments.

Leverage Extensive Experience

Proven Track Record

Over 20 ESRS-compliant double materiality assessments completed in the past 18 months.

Diverse Clientele

Experience with listed companies, state-owned enterprises, cross-border operations, and large local firms across various industries.

Efficient Processes

Apply a wealth of experience to ensure an efficient process and tangible outcomes.

Certified Expertise

Dedicated Team

Engage directly with experts holding MSc and PhD degrees in environmental and social disciplines, who have gained extensive experience working across both public and private sectors.

Personalised Support

Benefit from a team that speaks your language and is ready to answer all questions.

Collaborative Approach

Combine your industry insights with Sustinere’s expertise to form a strong partnership.